Your job is solely to make sure your own business practices align with PCI’s basic pointers. To guarantee PCI compliance, implement strong security measures similar to firewalls, unique passwords, and physical and digital knowledge safety. By following these greatest practices, you’ll have the ability to safeguard cardholder information and keep a secure payment surroundings. To guarantee credit card data is protected, companies should observe the 12 key necessities of PCI DSS compliance. In addition to the federal notices, employers should also show present state postings. Each state establishes its personal legal guidelines and mandates employers to adjust to required postings, including details about workers’ compensation, minimal wage, truthful employment, and so on.

If you’re not already PCI compliant, you may need to implement further security measures to guard your prospects’ sensitive information. This may embrace installing a tokenization system or encrypting sensitive data. Alternatively, you can find different safety companies that may allow you to with the PCI compliance assessment.

- Doing these easy things goes a good distance in preserving your business PCI compliant and protected.

- So we wanna ensure that your payroll expense is accurate as properly.

- Felicia Koss is a rising star on the earth of finance writing, with a keen eye for detail and a knack for breaking down complex subjects into accessible, partaking items.

- So go have a look and watch that should you haven’t had an opportunity to.

If they don’t, they may face fines and authorized motion, especially after a breach. PCI compliance keeps credit card numbers and different personal particulars safe. Ignoring them can result in heavy fines and a damaged status.

Know Your Federal, State, And Local Payroll And Tax Legal Guidelines

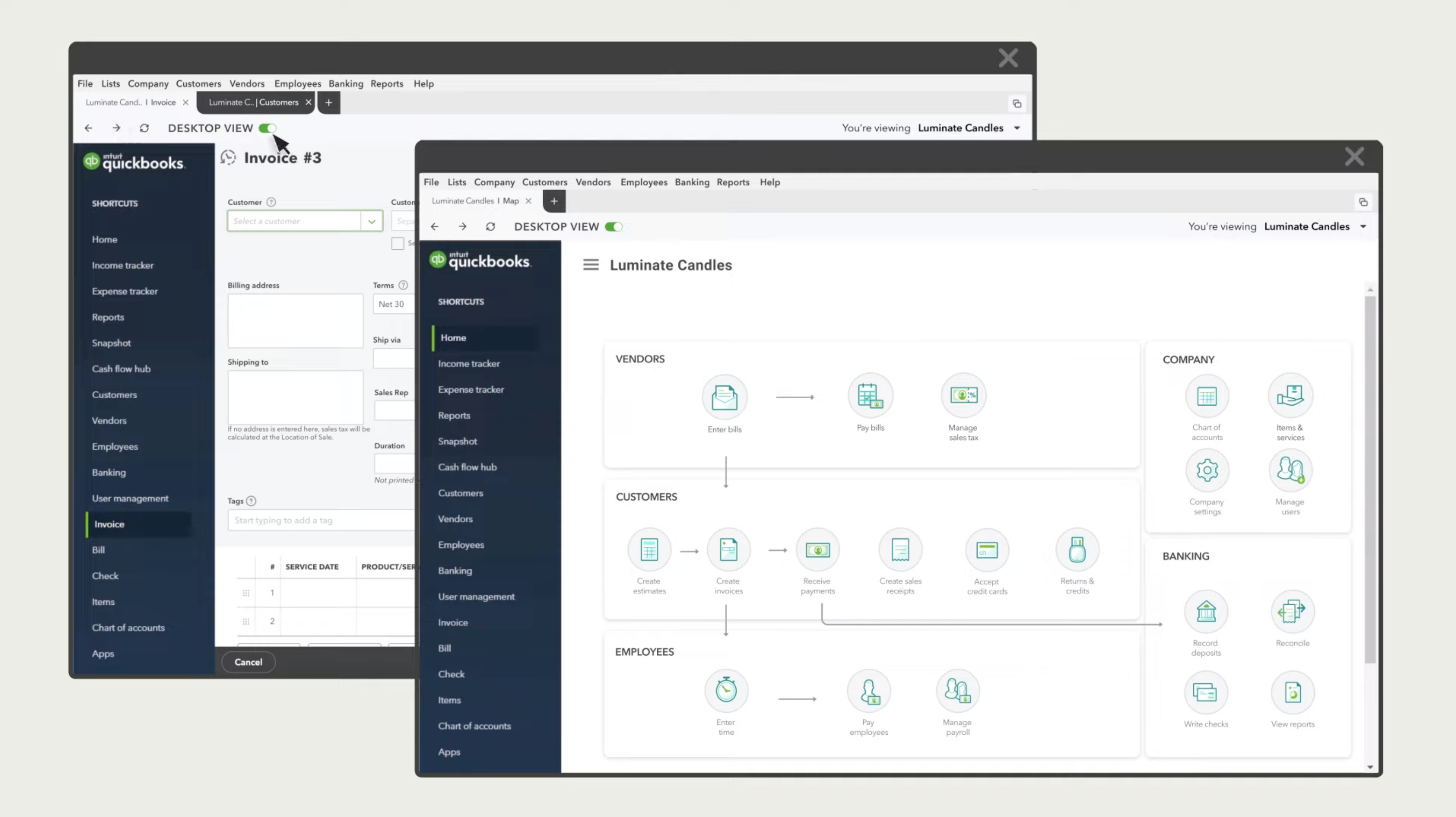

If you’re handling payments via a platform like QBO that already meets PCI standards, there’s no need to pay for redundant providers. There are four ranges of PCI compliance based mostly on transaction volume, however most small businesses utilizing instruments like QuickBooks Funds fall into Level four, which is the least burdensome. This means your necessities are much lighter — and often just involve a self-assessment and some primary best practices. To achieve PCI compliance in QuickBooks, you should observe the Payment Card Trade Data Safety Commonplace (PCI DSS) pointers. This contains using safe protocols for transmitting bank card information. If you may have Spanish-speaking employees, it’s really helpful to offer a federal poster in Spanish, in addition to the English model.

For further compliance requests or questions, please contact Responses might be provided inside 7 to 10 business days. The SOC 2 reports cover controls around security, availability, and process integrity of buyer data. To become PCI compliant, you may have to assess your current security practices and infrastructure. You Will https://www.quickbooks-payroll.org/ determine potential vulnerabilities and areas where enhancements are wanted. By taking these steps, you presumably can reduce the danger of a knowledge breach and shield your customers’ belief.

Assist

PCI applies to bank cards from the most important card manufacturers, together with Visa, MasterCard, American Categorical, Discover, and JCB. A third-party PCI Qualified Security Assessor (QSA) assesses firm systems and processes on an annual basis and issues an Attestation of Compliance (AOC) or Attestation of Validation (AOV) where applicable. PCI compliance is not just a regulation, nevertheless it’s an essential a half of managing buyer information responsibly and securely. Sure, Intuit and its QuickBooks On-line (QBO) merchandise are in fact PCI compliant but it is a shared duty.

All U.S. companies which have no less than 1 paid worker are required to show the most present federal and state postings. If you’ve greater than 1 enterprise location, you have to have posters at every location, displayed in conspicuous areas the place each applicants and employees can view them. Every time a mandatory change happens, all businesses must replace their postings. Learn more about federal poster necessities and state poster necessities. When you get into extra time legal guidelines and proper compensation, you wanna be certain that quickbooks compliance you’re having folks observe their time properly and accurately. Second, it helps you determine the place you’re profitable and where you’re not in your small business.

Ignoring PCI compliance can result in severe consequences, including hefty fines, legal liabilities, and loss of trust from customers. For exterior requirements, penalties are imposed by state authorities and may range from miniscule amounts to very serious penalties. As with charges and necessities, the fines and kinds of penalties will vary from state to state. It is in a company’s best curiosity to comply with necessities and stay in “good standing.” If not, a late fee or curiosity cost might be enforced. If a company stays out of “good standing” for too long, administrative dissolution may end result, which strips a company of its LLC or corporation advantages. PCI compliance is a set of technical and operational standards that companies must follow to guard credit card information.

How To Ensure Pci Compliance In Quickbooks?

At AllCents, we imagine each small business owner deserves to really feel confident dealing with all issues bookkeeping. Whether you’re DIY-ing your numbers or prepared to herald a professional, we’re here with the tools, ideas, and guidance you want. Doing these easy things goes a great distance in maintaining your corporation PCI compliant and guarded.

If your small business accepts, shops, or transmits payment card information, you have to be PCI compliant every year, as required by payment playing cards like Visa, MasterCard, American Express, and Uncover. We only issue the restricted guarantee on our QuickBooks Poster Compliance Subscription Service as a end result of the fact that labor laws change so frequently1. Until you order the subscription service, we have no means to make certain that you have the proper posters. It’s required to participate and complete the security metrics for PCI compliance when accepting payments in QuickBooks On-line (QBO). Finishing this can help you stop penalties, audit prices, and additional restrictions. Incorporating finest practices into your business operations not solely supports PCI compliance but additionally elevates your total information safety infrastructure.